tax per mile rate

Instead a portion of the rate is applied equaling 26 cents-per-mile for 2021 down one cent from 2020. With the correct number of axles.

Applicant Tracking Spreadsheet Download Free And Free Lead Tracking Spreadsheet Template Excel Templates Business Spreadsheet Template Spreadsheet Design

The standard mileage rate.

. The standard rate for medical and moving purposes is based on the variable costs as determined by the same study. Ad Compare Your 2022 Tax Bracket vs. For volunteer work the rate is 014mile.

Flatbed rates are at 314 per mile. Days Remaining to Update. Tax Rate Changes ALL QUARTERLY REPORTED IFTA TAX RATE CHANGES.

Discover Helpful Information and Resources on Taxes From AARP. For qualifying trips for medical appointments the rate is 016mile. Your 2021 Tax Bracket to See Whats Been Adjusted.

So for the 2022 tax year you are able to write off 0585 for every mile you drive up from 056 in 2021. The rate where the columns intersect is the tax rate in mills 110 of 1 cent. That is up about 45 from the 2021 rate of 56 cents per mile.

Tax Rate Matrix ALL IFTA TAX RATES. The standard mileage rate writes off a certain amount for every mile you drive for business purposes. What is the standard mileage rate.

Pennsylvania which has the highest fuel tax in the nation at 587 cents per gallon recently began discussions on whether or not an 81-cent-per-mile tax was appropriatethis would translate. Reefer rates are 319 per mile. Convert the mill rate to dollars per mile see examples below the chart.

Oregons tax rate of 18 cents per mile is equivalent to the 36-cent gas tax paid by a vehicle that gets 20 miles per gallon. 585 cents per mile driven for business use up 25 cents from the rate for 2021 18 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces up. Keep in mind that these are just averages and your business may profit from a different rate.

Some on social media are claiming that this punitive tax scheme has been slipped into President Bidens 12 trillion infrastructure spending legislationwhich after all is nearly 3000. In reality the vehicle mileage tax program that is included in the infrastructure bill proposes a three-year pilot program to study the viability of a road user charge. The current quarter is 2Q2022.

American drivers could soon trade paying taxes on gas at the pump for owing the government annual per-mile user fees. 15 rows Standard Mileage Rates. Users are expressing concerns about the cost of driving and incorrectly stating that it would cost drivers 8 cents a mile per a USA Today story.

The standard mileage rate for business is based on an annual study of the fixed and variable costs of operating an automobile. View the Matrix. Providing the lowest rates may not be enough to bring your revenue but a rate thats too.

19 Jurisdictions have updated their rates for this quarter. For automobiles a taxpayer uses for business purposes the portion of the business standard mileage rate treated as depreciation is 25 cents per mile for 2018 26 cents per mile for 2019 27 cents. This quarter 3 jurisdictions have changed their fuel tax rates.

What the county believes is just a 2-cent addition piles up to create around 075 per mile including an existing state-level gas tax of. The standard IRS mileage rate for the 2021 tax year is 056miles. Multiply your Oregon taxable miles times the rate to.

Understanding the Standard Mileage Rate. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. The IRS announced that beginning January 1 2022 the standard mileage rate for the use of a car will be 585 cents per mile.

The mileage tax deduction is calculated by multiplying qualified mileage by the annual rate set by the Internal Revenue Service. Someone driving about 11500 miles a. Likewise Ulrik Boesen a senior policy analyst at the Tax Foundation said in an email the purpose of this program is to study vehicle miles traveled taxes to understand how they could work The proposal for the pilot program also does not include an 8 cents per mile rate or any rate for that matter Boesen said.

For the 2022 tax year the standard milage rate is 585 cents per mile driven for business use up 25 cents from the rate in 2021. 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent from the rate for 2020 and. The following table summarizes the optional standard.

It may sound small but at an 8 cent rate that would be 1144 in new annual taxes for the average American who drives about 14300 miles a year. Pilot plan to tax drivers per MILE hidden in Bidens 12trillion deal.

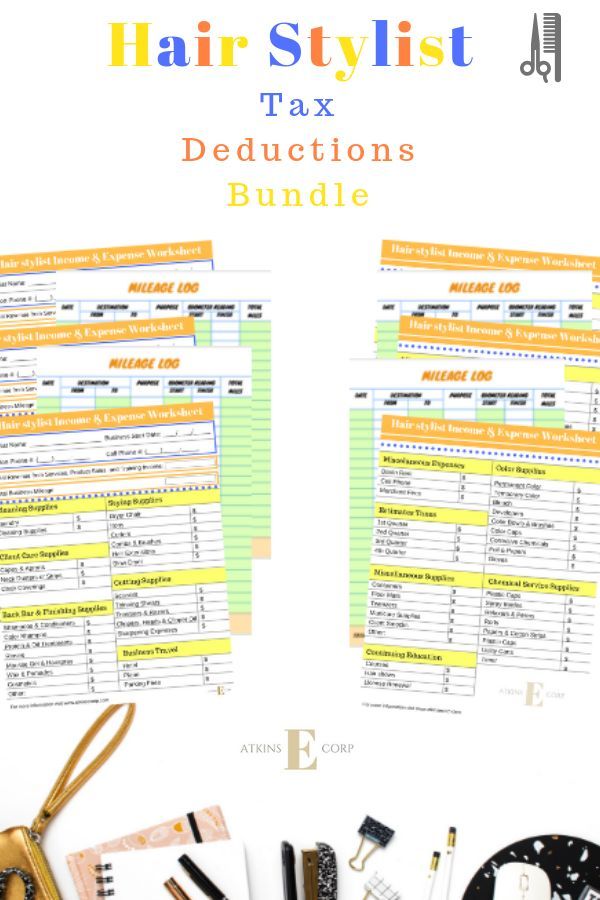

Stay Organized And Tax Ready With The Hair Stylist Income And Expense Worksheets With Mileage Logs This Bund Hair Stylist Income Tax Deductions Tax Write Offs

Souvenir Tuesday 1957 Twa Brochure Twa Vintage Travel Posters Vintage Disneyland

Pin By Carole Jones On Taxes Business 5 Cents Medical

2020 Irs Mileage Rates North Face Logo Retail Logos The North Face Logo

A Visual Guide To Tax Deductions How To Plan Plan Your Wedding Tax Write Offs

This Fuel Consumption Calculator Is An Excel Template To Calculate Average Cost And Mileage Per Liter Over Specific Per Excel Templates Book Template Templates

2020 Irs Mileage Rates North Face Logo Retail Logos The North Face Logo

Editable 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Wo Mileage Templates How Are You Feeling

Mileage Log Form For Taxes Lovely Mileage Log For Tax Deduction Template Templates Christmas Party Invitation Template Party Invite Template

There Are Two Methods Of Calculating The Costs Of Using Your Car For Business The Standard Mileage Rate And In 2022 Mileage Rate Profitable Business Tax Help

Folkes Worton Llp Chartered Accountants Stourbridge West Midlands Tax Refund Chartered Accountant Mileage

Planning A Business Travel Did You Know Standard Mileage Rates For 2018 Up From Rates For 2017 Follow Us For M Business Tax Tax Deductions List Tax Refund

Falcon Expenses Expense Report Template Expense Tracker Mileage Tracker App Tracking Mileage

Mileage Rate Update Financial Services Mileage Financial

13 Proven Mileage Tax Deduction Tips For 2019 The Handy Tax Guy Small Business Tax Deductions Business Tax Deductions Tax Deductions

Truck Expenses Worksheet Tax Deductions Printable Worksheets Spreadsheet Template

25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Excel Templates How Are You Feeling Mileage